Fraud Alert Investigation Workflow

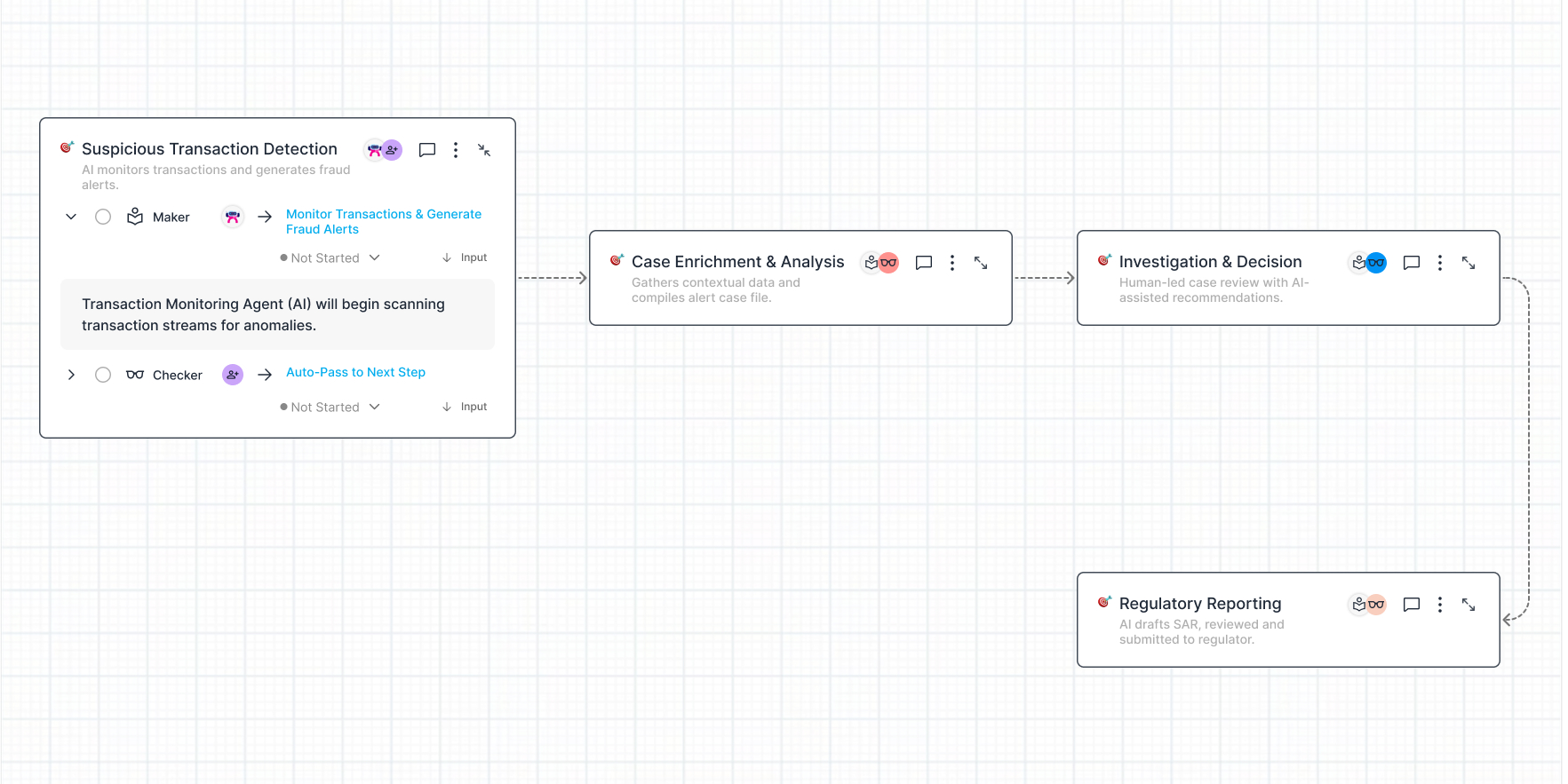

Automates fraud detection and investigation—monitoring transactions, enriching alerts, guiding decisions, and filing reports.

Fraud Alert Investigation Workflow

AI continuously scans transactions and flags suspicious activity. Alerts are enriched with contextual data and reviewed by analysts supported by AI. Confirmed fraud cases are compiled into SARs for final submission. The entire lifecycle—from detection to reporting—is streamlined through AI collaboration.

- AI monitors transactions and generates fraud alerts

- AI compiles additional data into enriched case files

- Human investigators assess cases with AI recommendations

- AI drafts suspicious activity reports (SARs)

- Reports reviewed and submitted by compliance

Business Impact

- Identifies fraud in real-time vs. hours or days

- Enables immediate case creation with enriched context

- Cuts false positives by 50%, saving review time

- Automates enrichment and reporting to free up teams

- 60% improvement in fraud detection accuracy

- Reduces regulatory penalties with audit-ready trails

Related Workflows

Fraud Alert Investigation Workflow

Automates fraud detection and investigation—monitoring transactions, enriching alerts, guiding decisions, and filing reports.

Client Onboarding & Compliance Workflow

Automates end-to-end onboarding of new wealth clients—capturing KYC, verifying documents, profiling investment suitability, and opening accounts.

Policy Service Endorsements Workflow

Streamlines policy change requests like address updates, beneficiary changes, or coverage modifications.

Continuous Loan Risk Monitoring Workflow

Monitors borrower activity post-loan to detect early risk, trigger intervention, and reduce defaults.

Regulatory Report Generation Workflow

Automates periodic compliance reporting—aggregating financial data, validating figures, and generating regulator-ready reports.

Small Business Loan Underwriting

Automates small business loan processing—from KYC to disbursement—enabling faster decisions, lower manual effort, and full compliance.

Fraudulent Claims Investigation Workflow

Identifies, investigates, and resolves fraudulent insurance claims using real-time AI surveillance and pattern recognition.

Portfolio Reporting Automation

Streamline the generation of monthly or quarterly performance reports with xnode’s AI-powered automation.

Policy Underwriting Automation Workflow

Automates insurance underwriting—collecting applications, assessing risk, generating quotes, and issuing policies with minimal manual effort.

Loan Collections & Recovery Workflow

Automates delinquency tracking, borrower outreach, negotiation, and escalation to maximize loan recovery.

Meet Your New AI Workforce.

Driving ROI for businesses by leveraging the power of AI to Transform Ideas into Impactful Applications.

QUICK LINKS

PRODUCT

LEGAL

RESOURCES

REACH US OUT

XNODE Inc. provides access to its platform on an “as is” basis, and by using the platform, you agree to hold XNODE harmless and indemnify it from any claims arising from your use. Any access to materials, software, hosting, data development, design, “generative” solutions or other things are provided “as is”. Any materials or designs created may not be saved and will be subject to deletion. By using the Platform you acknowledge that you will participate in feedback discussions and provide bug reports. XNODE reserves all rights to the Platform. XNODE is dedicated to protecting your personal data. Click here to view our Privacy Policy

Copyright © XNODE Inc., All Rights Reserved