Portfolio Reporting Automation

Streamline the generation of monthly or quarterly performance reports with xnode’s AI-powered automation.

Portfolio Reporting Automation

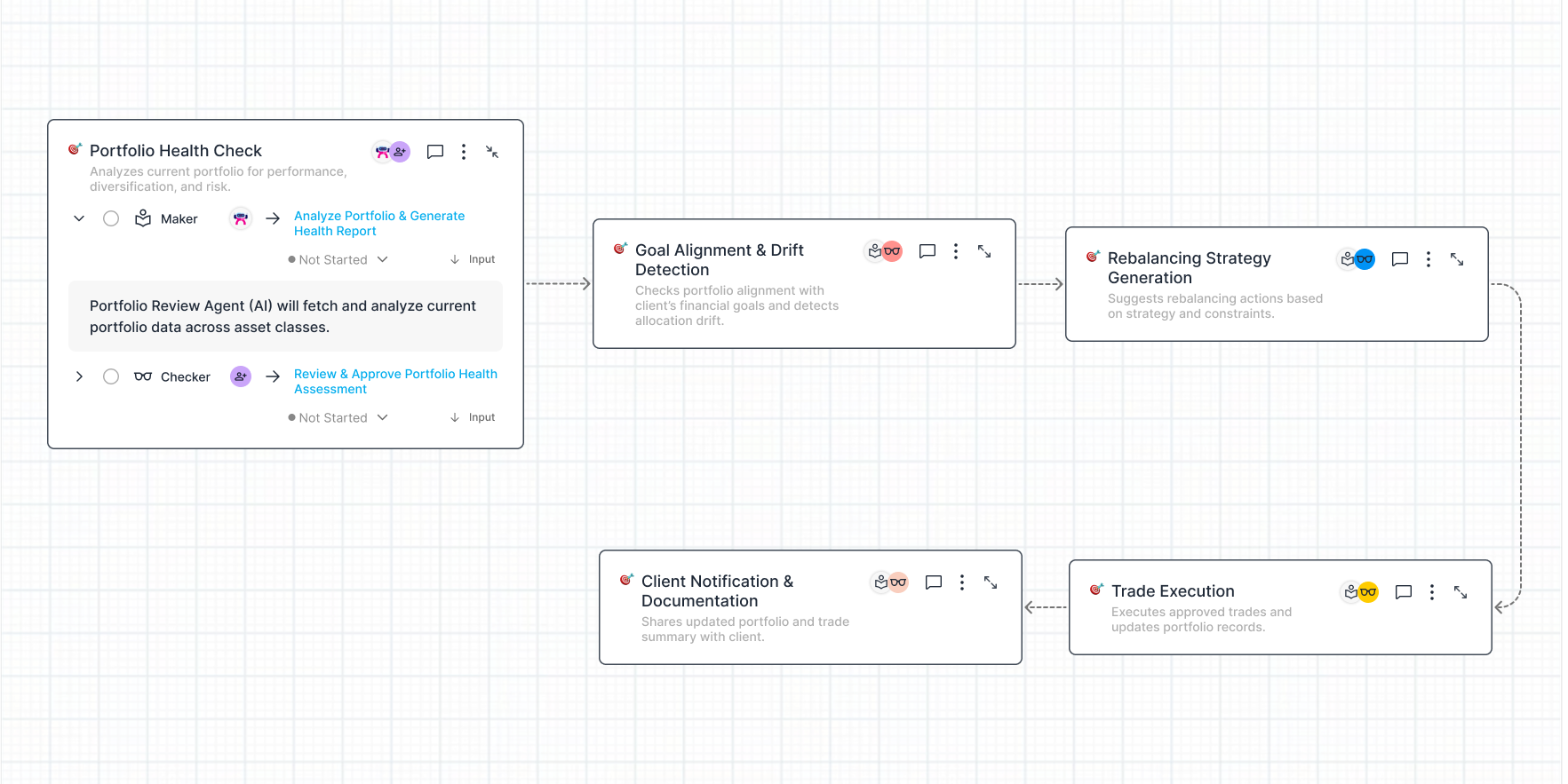

This workflow consolidates portfolio data from custodians and portfolio management systems, generates templated reports, and incorporates human oversight for personalized commentary and compliance validation, ensuring accuracy, timeliness, and professional delivery every cycle.

- Connect to custodian platforms and pull updated client holdings and transaction data.

- Pass the ingested data to the Report Drafting Agent.

- Generate a draft performance report using pre-configured templates.

- Review the draft report and add personalized commentary.

- Verify disclosures, legal disclaimers, and regulatory compliance.

- Release the finalized performance report to the client.

Business Impact

- 60–80% reduction in manual reporting effort

- Up to $28,000/year saved for firms with 100 clients

- Improved accuracy and consistency in client deliverables

- Reduced compliance risk with structured review and approval

- Faster turnaround time for report generation from hours to minutes

Related Workflows

Fraudulent Claims Investigation Workflow

Identifies, investigates, and resolves fraudulent insurance claims using real-time AI surveillance and pattern recognition.

Loan Collections & Recovery Workflow

Automates delinquency tracking, borrower outreach, negotiation, and escalation to maximize loan recovery.

Regulatory Report Generation Workflow

Automates periodic compliance reporting—aggregating financial data, validating figures, and generating regulator-ready reports.

Fraud Alert Investigation Workflow

Automates fraud detection and investigation—monitoring transactions, enriching alerts, guiding decisions, and filing reports.

Portfolio Reporting Automation

Streamline the generation of monthly or quarterly performance reports with xnode’s AI-powered automation.

Continuous Loan Risk Monitoring Workflow

Monitors borrower activity post-loan to detect early risk, trigger intervention, and reduce defaults.

Client Onboarding & Compliance Workflow

Automates end-to-end onboarding of new wealth clients—capturing KYC, verifying documents, profiling investment suitability, and opening accounts.

Small Business Loan Underwriting

Automates small business loan processing—from KYC to disbursement—enabling faster decisions, lower manual effort, and full compliance.

Microloan Origination & Group Lending Workflow

Automates field-based microloan issuance to groups—streamlining data collection, risk evaluation, and disbursement in underserved regions.

Policy Service Endorsements Workflow

Streamlines policy change requests like address updates, beneficiary changes, or coverage modifications.

Meet Your New AI Workforce.

Driving ROI for businesses by leveraging the power of AI to Transform Ideas into Impactful Applications.

QUICK LINKS

PRODUCT

LEGAL

RESOURCES

REACH US OUT

XNODE Inc. provides access to its platform on an “as is” basis, and by using the platform, you agree to hold XNODE harmless and indemnify it from any claims arising from your use. Any access to materials, software, hosting, data development, design, “generative” solutions or other things are provided “as is”. Any materials or designs created may not be saved and will be subject to deletion. By using the Platform you acknowledge that you will participate in feedback discussions and provide bug reports. XNODE reserves all rights to the Platform. XNODE is dedicated to protecting your personal data. Click here to view our Privacy Policy

Copyright © XNODE Inc., All Rights Reserved